It has begun, the world’s poorest billionaire Lawrence Stroll is no longer prepared to risk his $2BN personal wealth by shoring up Aston Martin’s perilous debt pile. Despite his best efforts, the world’s poorest billionaire has sold 8 percent of Aston Martin to Chinese automotive conglomerate Geely Motors. James Bond’s favorite supercar brand has long been an acquisition target for Geely. Geely’s 8-percent stake is surely the first small step towards an eventual giant takeover of Aston Martin.

When Aston Martin was close to bankruptcy in 2019 the company’s board members inexplicably chose Stroll’s survival investment pitch over Geely’s. Nevertheless, in the short term, Aston Martin will have access to Geely’s electric powertrain technology which is currently being used and developed by Geely-owned Volvo.

Aston Martin will also have access to lightweight materials technology courtesy of another Geely brand, Lotus Cars. Geely made several previous approaches to buy Aston Martin before the company went public in 2018. A successful acquisition would have seen Aston Martin move towards an EV-focused future, a proposal that was rejected by the board in 2018.

The world’s poorest billionaire Lawrence Stroll had sold a vision to turn Aston Martin into the ‘British Ferrari’ by expanding the company’s product portfolio to include a number of mid-engine supercars. But reality has set in, Aston Martin’s $1BN debt pile and continual losses risk the future stability of the company.

Because of the accumulated debt, Aston Martin is considered too risky by banks to loan money. So the company recently raised capital through a £654M rights issue which is like selling shares privately to approved investors and institutions.

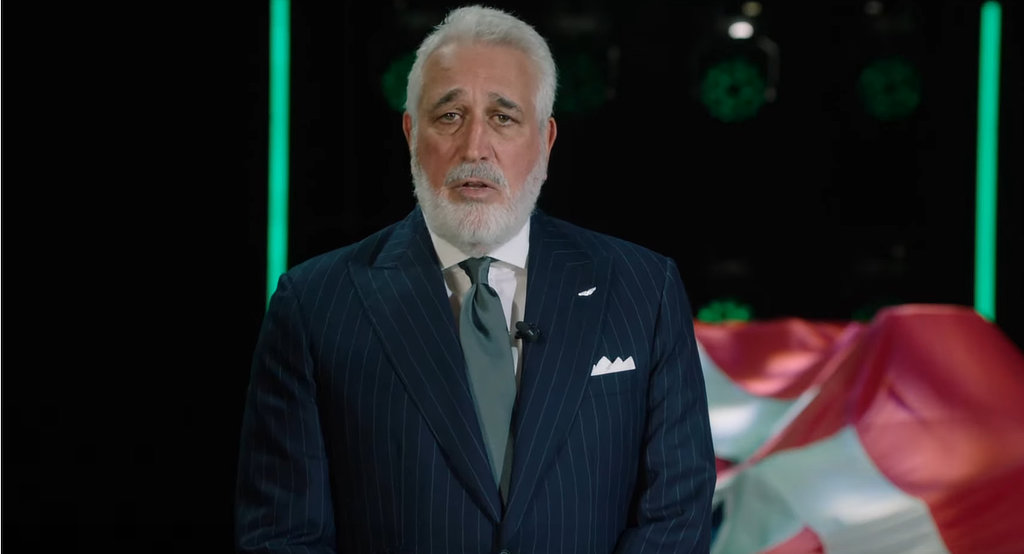

After the announcement was made today, Geely Holding chief executive Daniel Li said;

“…with our well-established record and technology offerings, Geely Holding can contribute to Aston Martin’s future success. We look forward to exploring potential opportunities to engage and collaborate with Aston Martin as it continues to execute its strategy to achieve long-term, sustainable growth, and increased profitability.”