Classic cars have always garnered interest throughout the years. Nostalgia and appreciation for older things (along with vintage car insurance) have led people to collect classic cars, as modern technology brings us closer to flying and solar-powered cars. Keeping the past alive for future generations is another reason why there is such a community around preserving cars. But are classic cars just toys for collectors, or are they a viable investment that can appreciate in value?

One thing that all motor vehicles share is they have value to varying degrees. New cars tend to depreciate over time as they get older, while a select few older cars increase in price as time passes due to several factors. Let’s go through these factors in more detail.

Value of the Car

The idea with all investments is that you buy something for a certain price, and then over time, the price increases, thereby making the investor money. Classic cars are no different; the right models must be purchased in order to make money. However, like all collectibles, they have to be kept in great condition to be worth top dollar.

Finding the Right Model

The critical thing to keep in mind here is that not all old cars are valuable. Just being old will not increase the value of a car; there has to be something else that makes it desirable to collectors.

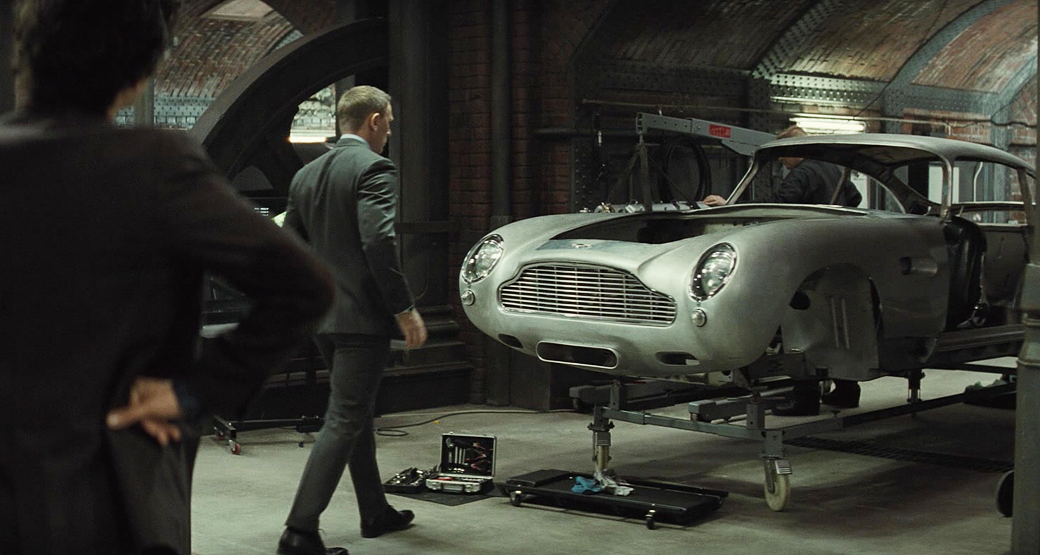

A lot of research is needed to find cars that have been featured in a film or models that are now rare or have rare features that increase their value. Proper research can save the buyer lots of money, as a certain amount of risk is involved in purchasing classic cars.

Scarcity

The rarer the car, the higher the price, generally speaking. The price of classic cars follows the same principles as all collectibles; they are worth as much as someone will pay for them. Including a rare classic car as a part of your portfolio can really boost its value, not to mention make it significantly cooler. Classic cars can be a great investment when carefully researched, and the right model is selected. This is also why it’s so important to purchase sufficient classic car insurance to protect the investment.

History

When investing in a classic vehicle, you are also investing in its history. Nothing sells better than a story, and this aspect of a classic car must be thoroughly investigated before a purchase is made. A good story will give the seller an advantage when selling, allowing a buyer to buy something well below its value if they know what to look for.

Some buyers may have a model in mind that their parents used to drive, and for that buyer, the car will be worth significantly more than a regular buyer. Always ensure that the model that is being purchased holds value on its own as well, not just to a specific buyer.

Brand

Popular car companies will have more expensive cars no matter their age. Companies that have produced quality cars for years are more trusted by buyers. Exotic and trendy car companies like Ferrari and Lamborghini will also have more buyers interested in them, increasing the price of any car carrying their branding.

Risks of Classic Car Investing

As with all investing, there is some risk involved in purchasing classic cars as investments, which is why so many investors opt for vintage car insurance when investing. The risk versus reward discussion is one that every investor has to have. The following are examples of the risks of classic car investing.

Volatility

There is no set price for classic cars, and their price will fluctuate depending on the state of the market at a specific time. Various trends result in the prices of different models increasing at the time of purchase.

This is why market volatility should be taken into consideration when investing in classic cars. A popular model might not experience the same demand in five years, so that must be taken into consideration.

Time Consuming

Researching hundreds and thousands of classic cars is extremely time-consuming, and the same can also be said for looking for classic car insurance. Between the investment of time finding the right car, this model might need some restoration, which cannot be done in a week or even a month. Consistent maintenance is also required, as these are older cars, and it may take a while before the right buyer is found.

Conclusion

Investing in classic cars can be risky and requires a lot of patience. There can be a lot of unforeseen costs as well, as some models can be in significantly worse condition than what they are made out to be, which is why it is critical to acquire classic car insurance when purchasing. The key is to be financially stable before investing so that you can handle any unforeseen expenses and wait patiently for the payday at the end.